Credit Card Analysis with Exponential Functions

Description

This activity allows students to analyze credit cards and interest rates. This challenging task gives students a glimpse into how credit card companies promote different cards and use interest to make money.

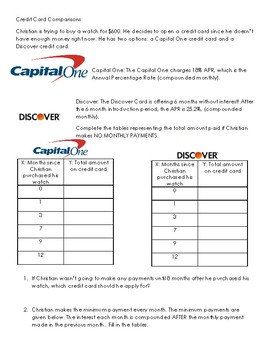

The task focuses on one central idea -- Christian wants to apply for a credit card to buy a $600 watch. Students compare two different credit card options with different APRs:

- Capital One

- Discover, which has the added bonus of 6 months without interest!

Students are asked to:

- Calculate balances over x months after interest is applied (but no payments are made)

- Calculate balances over x months while both making the minimum payment and being charged interest

- Determine functions to represent the monthly balance of each card

- Compare which credit card option is best under specific timelines

My students enjoyed this task because they learned real world skills (and many of them did not understand interest, payments, and other parts of the credit card world prior to this lesson!) We had several meaningful conversations, not just about the math, but about life skills. I used this task with my 8th grade students who are taking Algebra 1 (gifted and advanced students) and we spent an entire 80 minute period on this activity.