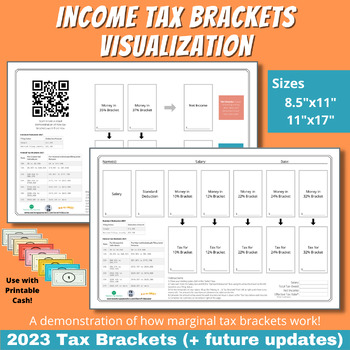

Federal Income Tax Visualization Activity | 2023 Filing Year | +Future Updates

- Zip

Also included in

- Income tax is one of the harder topics to teach in a personal finance curriculum and often one of the least exciting for students. We know how important it is, but it's hard to get excited about spreadsheets and percentages sometimes! This bundle is packed full of hands on resources to make understaPrice $27.99Original Price $56.95Save $28.96

Description

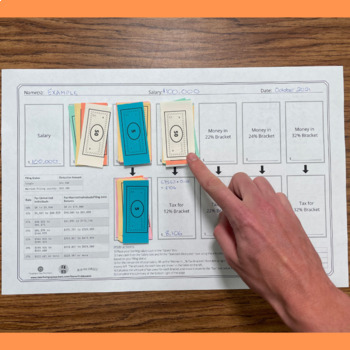

Do your students struggle to understand how income tax brackets work? Or maybe, like me, you are looking for something a bit more hands-on that they can see and manipulate to demonstrate how a marginal taxation system operates. Introducing this activity really increased my students' understanding of the progressive tax system as well as their engagement throughout the whole tax unit.

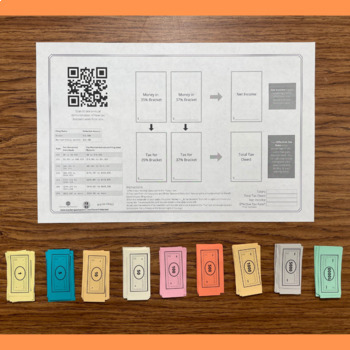

In this activity, students are going to calculate federal income tax using the rates for 2023 filing year. You can choose to have kids complete this activity using a pen and calculator, or you can do it with printable cash, which is the way I found my students learned best. You'll find the printable cash included in the resource.

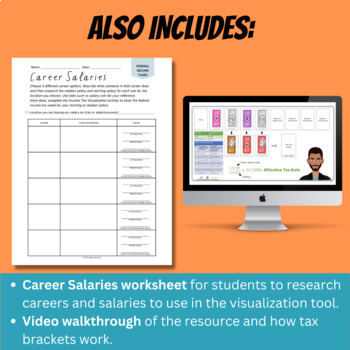

The activity sheet is available in 8.5"x11" and 11"x17". I recommend doing the 11"x17" if you are using printable cash to give everything space to fit. Also, print single-sided if you are going to use both parts of the activity (if using low-income amounts, the 2nd page can be optional). I've included a bonus Career Salaries worksheet where students can research 5 careers that they are interested in and the expected media/starting salary for each to use with this activity.

The resource also includes a video demonstration of the resource as well as an explanation for How Federal Income Tax brackets work.

If you are looking for more great resources about income tax, I have a Calculating Net Income Activity that gives students a career, salary, 401k contribution, state of residence, and filing status. They have to figure out the approximate Net Income of the person after calculating FICA taxes, Federal Income Tax, State Income Tax, and 401k contributions (Roth and Traditional). It's a great follow-up activity to this Income Tax Visualization Activity.

This product is priced to include all updates for future tax years and additions to the resource. You will be able to download the updated resource annually at no extra charge.